The integration of digital currencies into high-value transactions marks a clear paradigm shift in global finance. These new financial instruments are moving beyond mere speculative investment to become legitimate tools for daily commerce. This transformation is most evident within the luxury and leisure industries, where high-net-worth individuals are increasingly leveraging Distributed Ledger Technology (DLT) for transactions characterized by speed, transparency, and ease. Digital assets are a perfect match for the modern luxury market, which prioritizes exclusivity and efficient settlement.

The New Currency of Exclusive Assets

The luxury market is undergoing a fundamental transformation, fueled by new wealth generated within the digital space. Assets once confined to traditional banking infrastructure, such as fine art, supercars, and high-end real estate, are now frequently being acquired using crypto such as Bitcoin, Ethereum, and most reliably, stablecoins. This trend is not simply about offering an alternative payment method; it signifies a widespread cultural acceptance of decentralized finance as a primary medium of exchange for substantial sums.

Current data highlights this rapid institutional adoption. Research indicates that acquisitions conducted using digital assets often possess a considerably greater value than conventional credit card transactions, underscoring the transition toward high-stakes commerce. In the case of real estate, stablecoins facilitate massive, cross-border payments with speed and stability, offering both the buyer and the seller enhanced transparency.

This approach significantly reduces intermediary fees, often lowering transaction costs to approximately one percent, a notable saving compared to the two to five percent typical of international wire transfers. The increasing involvement of major wealth management firms further solidifies digital assets as a stable component of a diversified portfolio, actively encouraging new affluent buyers to leverage this wealth for luxury property investments.

The Infrastructure of High-Stakes Digital Commerce

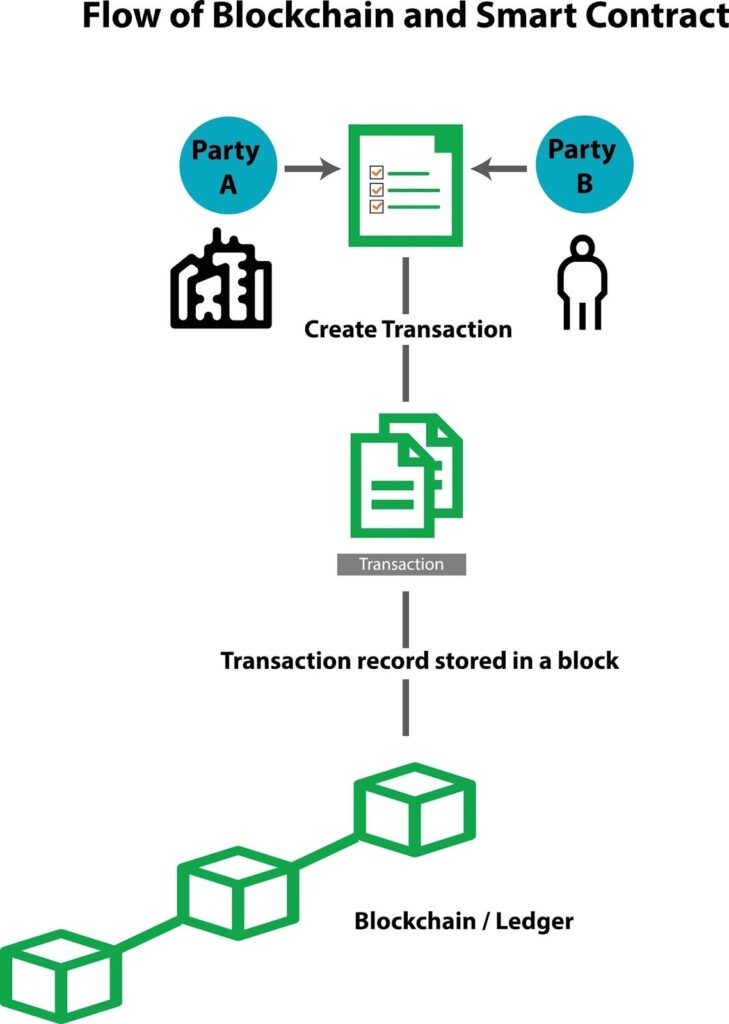

The primary benefit of digital currency for high-value leisure stems from its underlying technology: blockchain transactions are fast and permanent. DLT allows cross-border payments to settle instantly, securely, and with proof, unlike conventional settlements that can take days and be impossible to follow.

High-risk and time-sensitive enterprises require this reliability to transfer dollars and assets for a unique item or experience at the same time. These standards for quick, verifiable settlement apply to real-time gaming ecosystems, subscription-based entertainment services, and online gambling, where choosing a trustworthy, open platform is crucial to transaction security and reliability.

Strong security and following the rules are very important. Companies that help with high-value digital transactions, such private jet charters and fine art auctions, must follow rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. The Financial Action Task Force (FATF) and other global regulatory bodies have created worldwide standards for the transfer of digital assets. This makes sure that this new infrastructure enables legal business.

Fractional Ownership and Democratization

The fractionalization of high-value assets is a big new idea that is coming up. Blockchain technology lets you legally split up things like a vacation home, a unique piece of jewelry, or a yacht worth millions of dollars into hundreds or thousands of digital tokens. This technique lets many investors hold a verifiable piece of the asset, which makes it easier for people to invest in exclusive luxury and leisure assets. This fractional ownership model makes luxury investments available to a larger group of wealthy people who may not have been able to buy the whole asset outright before. It also gives the original owner quick cash flow.

Tokenizing Experiences and Digital Status Symbols

Digital currencies are changing the leisure economy in ways that extend beyond physical assets, enabling new forms of value transfer and ownership within the creative and entertainment industries. Non-Fungible Tokens (NFTs) have created an entire ecosystem of digital collectibles, providing users with permanent proof of ownership for everything from unique digital art to virtual real estate on metaverse platforms. This mechanism of creating digital scarcity has positioned virtual exclusivity as a key element of modern high-value leisure.

This tokenization is also extending to real-world experiences. Event planners and high-end travel companies are utilizing smart contracts to issue limited-edition access passes for exclusive resort stays or personalized adventure travel packages. The tradable nature of these tokens often turns a one-time purchase into a valuable, appreciating asset. The media and entertainment sector is seeing a surge in demand for digital payments, which reflects the consumer’s desire to use these assets for premium video streaming subscriptions and interactive entertainment. This change is bringing about a transformation in the economics of high-end digital content distribution by guaranteeing that content producers get timely, consumption-based royalty payments, which is accomplished by facilitating more secure and quicker transactions and by doing away with intermediaries.

Leave a Reply